Democratic mayoral hopeful Zohran Mamdani plans to freeze rent and make buses free by taxing the rich

NEW YORK – Millionaires in New York City will be faced with the prospect of a tax rise if Democratic candidate Zohran Mamdani wins the mayoral election on Tuesday.

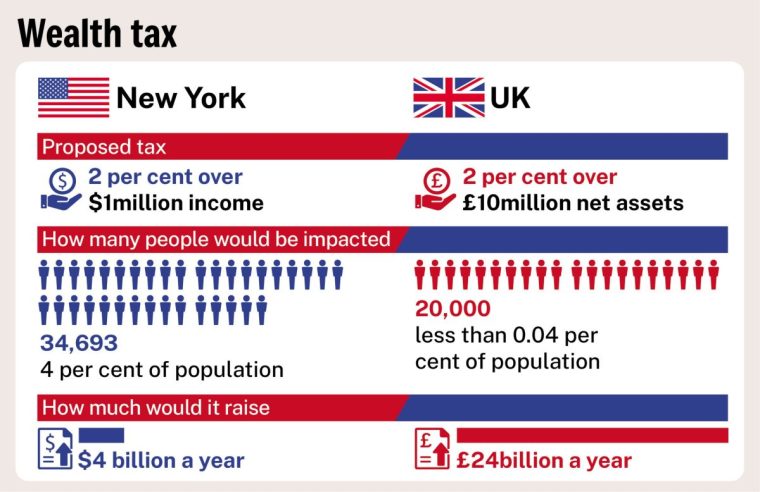

His proposal to implement a 2 per cent tax surcharge on those earning over $1m (£760,000) has come under fire from critics who say the policy will spook the city’s wealthiest.

This week, however, several millionaires said the “millionaire tax” — which Mamdani claims would raise $4bn (£3bn) annually — would help tackle the “extreme inequality” in the city, and predictions of a mass exodus by millionaires were untrue.

It comes as the debate over taxing the rich grows louder in the UK ahead of the Budget, with the Government under pressure to raise funds from the wealthiest.

The majority of British wealth tax campaigners have argued for a 2 per cent tax on wealth over £10m. The Patriotic Millionaires UK network reported that, of 511 millionaires surveyed, 80 per cent supported the measure and that it would raise £24bn a year.

Speaking to The i Paper at his Upper West Side apartment in Manhattan, where his neighbour is Bono, Andrew Tobias said that he was “absolutely” in favour of the policy and that there was no way that paying “a little extra” would make him leave New York.

He said: “If you’re already making a fortune, what difference does it make ? If you’re making $50m a year, are you really going to say, I can’t stay in New York City because I have to pay 2 per cent more of the $50m? If you’re living comfortably and other people are suffering, it’s got to make you do something about it.”

Tobias, a venture capitalist who has authored several investments guides, has been supportive of a wealth tax for more than a decade, but said even millionaires who have opposed the measure would stay and pay it if it came into effect.

“They’re competitive, they want to see their fortune go up, they’re not eager to pay extra tax unless they have to, but if they have to they will,” he added.

Marc Baum, a New York finance man who made his money “doing a bit of everything”, said that there had “always been an understanding that we should spread wealth around” and that drastic action was needed to tackle ever-increasing inequality.

He said: “I believe in all the stuff that we rely on. I believe in the streets, and I believe in the schools, and I believe in feeding people, and I believe in funding healthcare.”

Opponents of the wealth tax – in the US case, a tax on income rather than assets – have warned that millionaires need only move across state lines to New Jersey or Connecticut to hypothetically save millions in annual taxes.

But Baum said that people live in New York for the culture and the opportunities rather than a low tax rate.

“It’s a fractious election,” said Baum. “One of the things [my friends] say, they talk about the wealth tax, but if you say, ‘But are you going to leave?’ they go, ‘Oh no’.

“The wealthy who have chosen to leave, who did so because of the pandemic, because of all kinds of other reasons, those people have already left.”

Indeed, the trained lawyer, who has lived in New York for more than four decades, said that Mamdani had excited people by “grappling with the affordability issues” and was starting to popularise the idea of the wealth tax. “It’s all about rebranding,” he said.

The mayoral hopeful has said he plans to freeze rent and make buses free if he wins on Tuesday, but has come under fire for making promises that he probably won’t be able to keep, including taxing the rich.

Legacy Democrats like Baum have pointed out that Mamdani will most likely run into problems and be blocked by the state governor. Despite this, Baum said the policy had been “helpful” in bringing the wealth tax debate into the mainstream.

“It has created a conversation, and the conversation itself becomes [energising].”