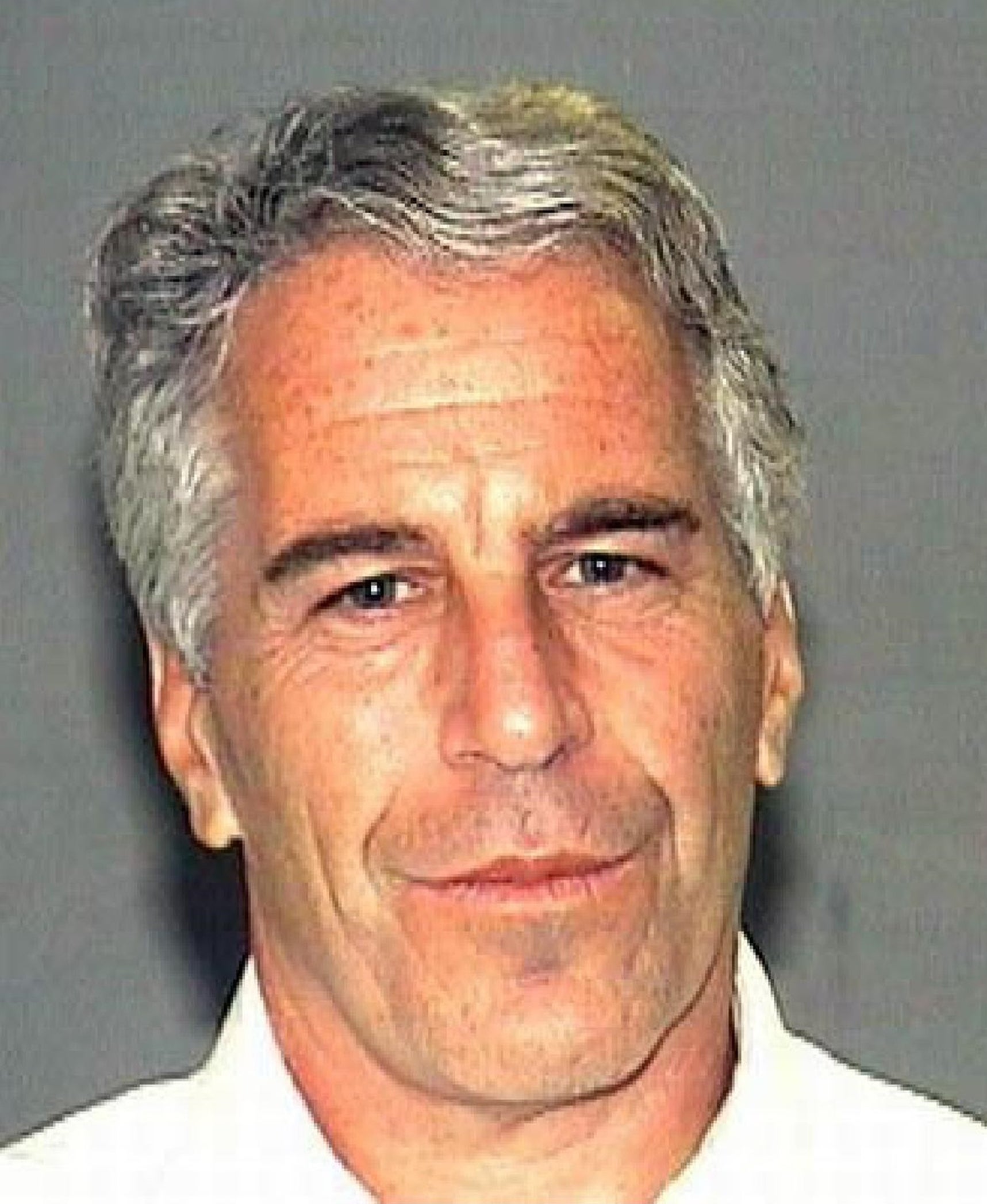

Just weeks after Jeffrey Epstein died in jail in 2019, banking giant JPMorgan Chase alerted the Trump administration to more than $1 billion in potentially suspicious transactions involving several high-profile U.S. business figures, as well as wire transfers to Russian banks.

The report, which JPMorgan filed – and which was released this week among hundreds of pages of previously sealed court records – flagged over 4,700 transactions, amid concerns they could potentially be related to human trafficking operations involving Epstein.

Among the names highlighted in JPMorgan’s suspicious activity report are: Leon Black, co-founder of private equity firm Apollo Global Management and former MoMA chairman; billionaire hedge fund manager Glenn Dubin; celebrity attorney Alan Dershowitz; and trusts linked to retail magnate Leslie Wexner.

Though each man appeared in connection with financial dealings tied to Epstein, what those transactions involved, and precisely how Epstein fits into the picture, remains unclear. None of them has been charged with crimes in connection with the disgraced financier.

According to The New York Times, which – alongside The Wall Street Journal – requested the documents to be made public, the report alerted authorities to wire transfers to Russian banks, while also mentioning sensitivities surrounding Epstein’s “relationships with two U.S. presidents.” Epstein is known to have been close to President Trump and former President Bill Clinton.

The report offered few specifics about the suspicious transactions or why they raised red flags, other than their apparent ties to Epstein.

Key points it highlights include $65 million worth of wire transfers linked to trusts controlled by retail billionaire Wexner. The transfers, dating back to the mid-2000s, appeared to pass through multiple banks.

Epstein served as a trustee for some of Wexner’s trusts and acted as a close financial adviser for nearly 20 years.

Wexner’s business empire included retailers such as The Limited and Victoria’s Secret. Following Epstein’s death, Wexner publicly accused him of misappropriating “vast sums” of money.

The JPMorgan report did not provide details about the transactions involving the Blacks, the Dubins, or Dershowitz; however, links between some of them are already known.

Epstein had numerous ties to Dubin. The disgraced financier had played a key role in brokering the sale of Dubin’s firm to JPMorgan – a deal that earned Epstein a $15m fee. Epstein had also previously dated Dubin’s wife, Eva Andersson-Dubin, and was named godfather to the couple’s children.

The report flagged undisclosed financial activity involving Epstein and Black, his wife, and a family partnership. A recent article by The New York Times also revealed Black had paid Epstein around $170 million over several years, along with hundreds of thousands of dollars to at least three women linked to Epstein.

In response to the news of the suspicious activity report’s contents, Dershowitz, who was one of Epstein’s criminal defense lawyers, told The New York Times: “The only funds I ever received from Jeffrey Epstein were payments for my legal services based on my hourly rates.”

A spokesperson for the Dubins told The Independent: “During this 16-year period, there were 12 transactions between the parties, all of which related to charitable giving, personal gifts, or business matters. These transactions, which have all been previously reported, bore no connection whatsoever to the abhorrent conduct later revealed in relation to Mr Epstein. As Glenn and Eva Dubin have previously stated, they were horrified to learn of his vile and unspeakable actions.”

JPMorgan – the U.S.’s largest bank – is also under increased scrutiny after it worked with Epstein for over a decade, during which he is believed to have sexually abused over 200 young women and girls, as young as 14.

However, a spokesperson for the bank stated that the documents indicated JPMorgan had made repeated efforts to alert regulators to concerns surrounding Epstein by filing suspicious activity reports.

“It does not appear that anyone in the government or law enforcement acted on those SARs for years,” a spokesperson for the bank said.

According to The Times, the bank also said it regretted its involvement with Epstein but was not aware of his sexual abuse.

The Independent has contacted JPMorgan Chase and the individuals named in this report for further comment.