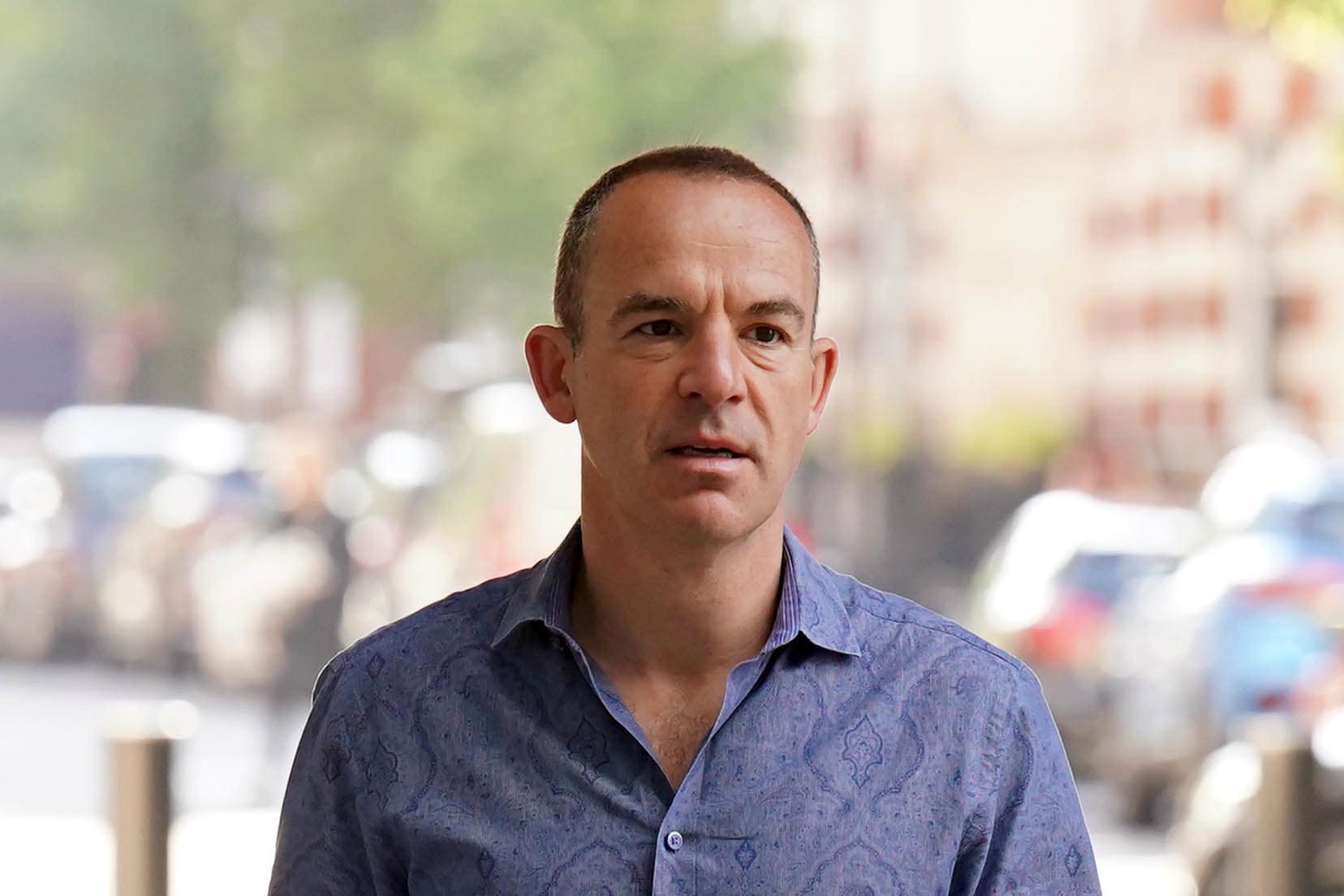

Martin Lewis has explained what drivers could be owed amid the UK’s car finance scandal, and how to navigate making a claim.

The regulator said motor finance firms broke the law or its rules by not properly informing customers about commission paid by lenders to the car dealers which sold them the loan.

Anyone who bought a car on hire purchase or personal contract purchase between April 2007 and November 2024 could be eligible for the redress scheme.

The average payout is expected to be £700 per agreement, with lenders facing a £8.2bn compensation bill.

Some four million car finance deals are estimated to have already been subject to a complaint, leaving around ten million which still could be raised.

This is what the Money Saving Expert founder has to say

Explaining in a new video on moneysavingexpert.com, Mr Lewis said the average payout will be roughly 17 per cent of the interest charged.

“So for every £1,000 of interest you were charged, you’ll get back £170 – and that’s being done on average,” he said.

“It’s not a case-by-case basis, so some people maybe will be worse off because of this, some people will be slightly better off because of this.”

Mr Lewis added that most cases will follow this line, but he noted that a minority of people had a commission on their loan that was over 50 per cent of the cost of credit, and over 22.5 per cent of the total cost of borrowing. These cases will be given a commission based on the Johnson case in the Supreme Court.

“Effectively, you’ll get all the commission and the interest paid back, so you’ll get a lot more money back. It’s only a small number of people,” he explained.

How to make a claim

Mr Lewis said if you already put in a complaint, the car finance firm will have three months to write to you to inform you that you are included in the scheme, which he described as a “near automatic payout”.

If you have not already complained, then the car finance firms have to identify all those mis-sold and need to get in touch with you within six months of the scheme starting, and you can decide to opt in.

However, the Money Saving Expert founder suggested putting in a complaint as soon as possible, so you are already included in the scheme.

Mr Lewis advised against using a claims firm because they will charge commission, and instead urged people to use a template letter on his website.

The letter only works for discretionary commission arrangements. Mr Lewis and the Money Saving Expert team will be working on letters for contractually tied deals and the “unfairly high” commission system in the coming weeks, he said.

For people who are worried they have been mis-sold a long time ago and are struggling for evidence, Mr Lewis said: “Have you got any proof that you had a car finance deal at that time? I’m saying an old credit reference file that includes it, an old bank statement, or a form where [you can prove that] you were paying them.

“If you do, that could be enough. What they’ll then probably look at is whether that firm was systemically doing one of these categories [of mis-selling] to people in your situation at the time and, if so, it’s possible you will get a payout.”

The Financial Conduct Authority’s (FCA) chief executive, Nikhil Rathi, declared it was time that “customers get fair compensation” while announcing the scheme, which he said “aims to be simple” for people to use and lenders to implement.

“We recognise that there will be a wide range of views on the scheme, its scope, timeframe and how compensation is calculated,” he added. “On such a complex issue, not everyone will get everything they would like. But we want to work together on the best possible scheme and draw a line under this issue quickly.”